In the fast-paced world of trading, understanding market psychology and price movements is crucial for success. In this article, we delves into essential candlestick patterns that signal potential market reversals from bullish to bearish. These patterns not only provide insight into market sentiment but also serve as valuable tools for traders looking to make informed decisions and optimize their trading strategies.

Bearish Reversal Patterns:

Bearish reversal patterns are vital in technical analysis, offering traders critical signals that indicate when a market may be losing upward momentum. Recognizing these patterns on candlestick charts allows traders to anticipate potential downturns in asset prices, providing opportunities to enter short positions or protect existing profits. By mastering these 13 patterns, traders can enhance their ability to read market conditions, manage risks more effectively, and seize profitable opportunities in various financial instruments, including stocks, forex, and cryptocurrencies. With a robust understanding of these patterns, traders can make confident, strategic decisions in their trading endeavors. Let’s dive into the top 13 popularly used bearish reversal patterns in candlestick chart.

| Pattern | Description |

Bearish Engulfing

| - Pattern Class: Two Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Bearish harami consists of a large bullish candle followed by a small bearish candle.

- Psychology Behind Formation: Indicates bears starting to gain control after buying pressure.

- Market Sentiment Shift: Suggests potential reversal near market tops or significant highs.

- Trading Opportunity: Traders consider selling after confirmation of the bearish harami pattern.

- Predictive Accuracy: Approximately 63% success rate in forecasting bearish reversals.

|

Bearish Harami

| - Pattern Class: Two Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Bearish harami consists of a large bullish candle followed by a small bearish candle.

- Psychology Behind Formation: Indicates bears starting to gain control after buying pressure.

- Market Sentiment Shift: Suggests potential reversal near market tops or significant highs.

- Trading Opportunity: Traders consider selling after confirmation of the bearish harami pattern.

- Predictive Accuracy: Approximately 63% success rate in forecasting bearish reversals.

|

Tweezer Top

| - Pattern Class: Two Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Tweezer top consists of two or more candles with identical highs.

- Psychology Behind Formation: Indicates resistance as buyers fail to push higher.

- Market Sentiment Shift: Signals potential reversal from bullish to bearish trend.

- Trading Opportunity: Traders look to sell after confirmation of the pattern.

- Predictive Accuracy: Approximately 61% success rate in forecasting bearish reversals.

|

Evening Star

| - Pattern Class: Three Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Evening star consists of a bullish candle, doji, and bearish candle.

- Psychology Behind Formation: Reflects buyer indecision followed by seller dominance.

- Market Sentiment Shift: Indicates potential reversal from bullish to bearish trend.

- Trading Opportunity: Traders seek to sell after confirmation of the pattern.

- Predictive Accuracy: Approximately 69% success rate in forecasting bearish reversals.

|

Evening Star Doji

| - Pattern Class: Three Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Evening star doji consists of a bullish candle, doji, and bearish candle.

- Psychology Behind Formation: Indicates buyer indecision followed by seller dominance.

- Market Sentiment Shift: Signals potential reversal from bullish to bearish trend.

- Trading Opportunity: Traders look to sell after confirmation of the pattern.

- Predictive Accuracy: Approximately 68% success rate in forecasting bearish reversals.

|

Bearish Abandoned Baby

| - Pattern Class: Three Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Bearish abandoned baby consists of a bullish candle, doji, and bearish candle.

- Psychology Behind Formation: Reflects buyer indecision followed by strong seller control.

- Market Sentiment Shift: Indicates a potential reversal from bullish to bearish trend.

- Trading Opportunity: Traders look to sell after confirmation of the pattern.

- Predictive Accuracy: Approximately 78% success rate in forecasting bearish reversals.

|

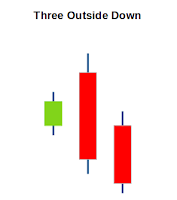

Three Outside Down

| - Pattern Class: Three Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Three-outside-down consists of a bullish candle followed by two bearish candles.

- Psychology Behind Formation: Indicates loss of bullish control and increased selling pressure.

- Market Sentiment Shift: Signals potential reversal from uptrend to downtrend.

- Trading Opportunity: Traders consider selling after confirmation of the pattern.

- Predictive Accuracy: Approximately 67% success rate in forecasting bearish reversals.

|

Three Inside Down

| - Pattern Class: Three Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Three inside down consists of a bullish candle followed by two bearish candles.

- Psychology Behind Formation: Reflects buyer weakness and growing seller momentum.

- Market Sentiment Shift: Indicates potential reversal from bullish to bearish trend.

- Trading Opportunity: Traders look to sell after confirmation of the pattern.

- Predictive Accuracy: Approximately 64% success rate in forecasting bearish reversals.

|

Hanging Man

| - Pattern Class: One Candle Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Hanging man consists of a candle with a long lower wick and minimal upper wick.

- Psychology Behind Formation: Indicates buyer weakness and potential loss of upward momentum.

- Market Sentiment Shift: Signals possible reversal from bullish trend to bearish trend.

- Trading Opportunity: Traders may sell after confirmation of the hanging man pattern.

- Predictive Accuracy: Approximately 59% success rate in forecasting bearish reversals.

|

Bearish Kicker

| - Pattern Class: Two Candle Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Bearish kicker consists of a bullish candle followed by a strong bearish candle.

- Psychology Behind Formation: Indicates strong rejection of bullish sentiment by sellers.

- Market Sentiment Shift: Signals abrupt transition from bullish to bearish trend.

- Trading Opportunity: Traders may sell after confirmation of the bearish kicker pattern.

- Predictive Accuracy: Approximately 70% success rate in forecasting bearish reversals.

|

Dark Cloud Cover

| - Pattern Class: Two Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Dark cloud cover consists of a bullish candle followed by a bearish candle.

- Psychology Behind Formation: Indicates strong rejection of bullish momentum by sellers.

- Market Sentiment Shift: Signals potential reversal from bullish trend to bearish trend.

- Trading Opportunity: Traders may sell after confirmation of the dark cloud cover pattern.

- Predictive Accuracy: Approximately 65% success rate in forecasting bearish reversals.

|

Shooting Star

| - Pattern Class: One Candle Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Shooting star consists of a single candle with a long upper wick.

- Psychology Behind Formation: Reflects buyer rejection and seller dominance at market peak.

- Market Sentiment Shift: Indicates potential reversal from bullish trend to bearish trend.

- Trading Opportunity: Traders may sell following confirmation by a strong bearish candle.

- Predictive Accuracy: Approximately 59% success rate in forecasting bearish reversals.

|

Three Black Crows

| - Pattern Class: Three Candles Pattern.

- Pattern Signal: Bearish Reversal.

- Formation: Three black crows consist of three consecutive bearish candles with lower lows.

- Psychology Behind Formation: Indicates a shift from bullish optimism to bearish control.

- Market Sentiment Shift: Signals potential reversal after a bullish rally.

- Trading Opportunity: Traders may sell following the confirmation of this pattern.

- Predictive Accuracy: Approximately 78% success rate in forecasting bearish reversals.

|

How These Patterns Help Traders Spot Opportunities

Bearish reversal candlestick patterns are vital tools for traders aiming to detect potential market downturns. By identifying these patterns, traders can find opportunities to exit long positions or enter short trades before a downtrend begins. Typically, these patterns emerge following a bullish rally, indicating a shift in market sentiment from buyers to sellers.

Mastering these bearish reversal patterns allows traders to assess market momentum accurately. As bearish signals develop, traders can recognize increasing selling pressure, which provides a significant advantage in their decision-making process. This proactive strategy facilitates improved risk management and can lead to better overall trading performance.

By spotting these patterns on candlestick charts, traders can predict price declines, effectively manage risks, and uncover favorable selling opportunities. Understanding the essential characteristics and implications of these patterns empowers traders to make more informed choices, ultimately refining their trading strategies.

In conclusion, mastering bearish reversal patterns equips traders with the necessary tools to navigate changing market conditions confidently. Whether employed to exit positions or initiate new ones, these patterns play a vital role in maintaining a proactive approach in trading. As markets continue to evolve, traders who incorporate these patterns into their analysis can increase their chances of identifying profitable opportunities and mitigating potential losses, leading to greater overall success in their trading endeavors.